The World We Want Foundation

Change is happening. Right now.

The World We Want Foundation (3W) is a Stockholm based philanthropic organization. We identify and support local visionaries who provide high-impact solutions to poverty and environmental degradation in developing countries. We work with initiatives that are well-defined, limited in scope, and managed by local and dedicated teams.

About us

“Charitable Investments are no different than any kind of investment. They require thorough due diligence, commitment, engagement, and nurturing for maximum results and impact.”

- Paul, 3W Founder

Pioneered by an asset management investor, 3W uses a financial approach to maximize impact: carefully evaluating each project, taking a long-term position, and actively engaging with the organization through iteration and implementation….all while trying to be patient. One thing we have learned is that truly transformative models take time.

Our story began in 2005, when Paul Leander-Engström founded 3W. Paul’s ambition was to apply his business skills and financial success to support models of transformative change. Today, 3W has a very engaged and competent board to support and govern the organization. Our board members offer a mix of expertise in business competence, investment management, and an intense interest in development theory and practice.

Meet our Board and Advisors

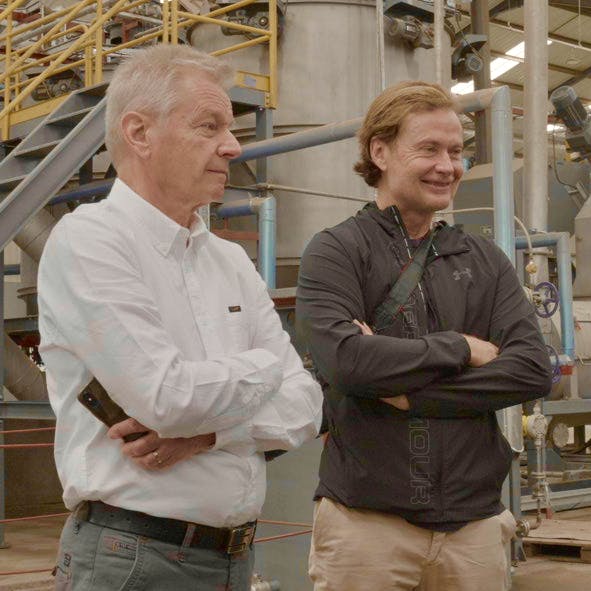

3W Founder and Chairman of the Board

Paul Leander-Engström

Following a successful career with focus mostly on Russia, Paul joined forces with Jacob Röjdmark, and founded Ture Invest in 2007. Ture Invest is the leading direct lender in the Nordic countries. Paul is the chairman of 3W, a board member of Ture Invest, Virunga National Park and T3 Kenya, as well as a published writer. A mini-series based on one of his books hit the small screen in 2019 and was nominated for the Golden Nymph Award at the Monte Carlo Television Festival. Paul is a graduate of Stockholm School of Economics, Stockholm University Law School, and the Military Intelligence and Interrogation School in Uppsala.

3W Managing Director/Board Member

Kirsten Poitras

Kirsten began her career with Procter & Gamble where she held numerous brand management positions. Wanting to get involved in International Development and poverty alleviation, she went on to study International Affairs at The Fletcher School in Boston and received her Master’s in 2009. Kirsten is a member of the 3W and Ture Invest boards in Stockholm, a director for the T3 Recycling board in Kenya and ENLA Haiti, as well as a board observer for OMC Power in India. Kirsten has an undergraduate degree in Political Science from the University of North Carolina at Chapel Hill and an MBA from the University of San Diego.

3W Board Director

Jacob Röjdmark

Jacob is founder and CEO of Ture Invest, the Nordic leader within direct lending. Prior to founding Ture Invest in 2007, Jacob held several senior positions at AB Industrivärden between 1996 and 2006, including Head of Research and Head of New Investments. Jacob was also a member Industrivärden’s Management Team. Before that, Jacob was Associate Director at Indosuez Capital and Head of Credit at the bank’s Nordic operations between 1992 and 1996. Jacob has been on the Board of Directors of several companies including TTS Pass AB, Selected Brands AB, Future Eyewear Group AB, AB Svensk Bilprovning, Establish AB and DHJ Media AB. Jacob holds an M.Sc. in Business and Economics from the Stockholm School of Economics.

Industrial Advisor

Leif Nilsson

As a former CEO of Trioplast Landskrona and Arla Plast, Leif has a lifetime of experience in waste management and recycling. In addition to the many board positions he currently holds, including T3 in Kenya, he has chaired the Swedish Plastic Industry Association, SPIF, and been a board member of the Swedish Plastics Recycling in Motala AB. Leif has been involved in numerous EU projects related to plastic production and has participated in a number of different projects and investigations within plastics, recycling and the circular economy. He is a Chemical Engineer and earned a Masters of Science in Engineering, Polymer Chemistry, Chemical Technology from Lund University.

Education Program Advisor

Dora Nemere

Dora started working in Haiti in 2011 in a residency for children with disabilities where she designed and implemented new educational and therapy programs. She later moved on to an international NGO where she managed education and community development programs. In 2015, she became responsible for the ENLA kindergarten and primary school in rural Haiti where she worked on improving the quality of education and launching new programs to meet the challenges of life in Haiti. She is 3W’s educational advisor and is on the board of ENLA Haiti. Dora has a Masters from Eötvös Loránd University in Budapest. She speaks Haitian Creole fluently.

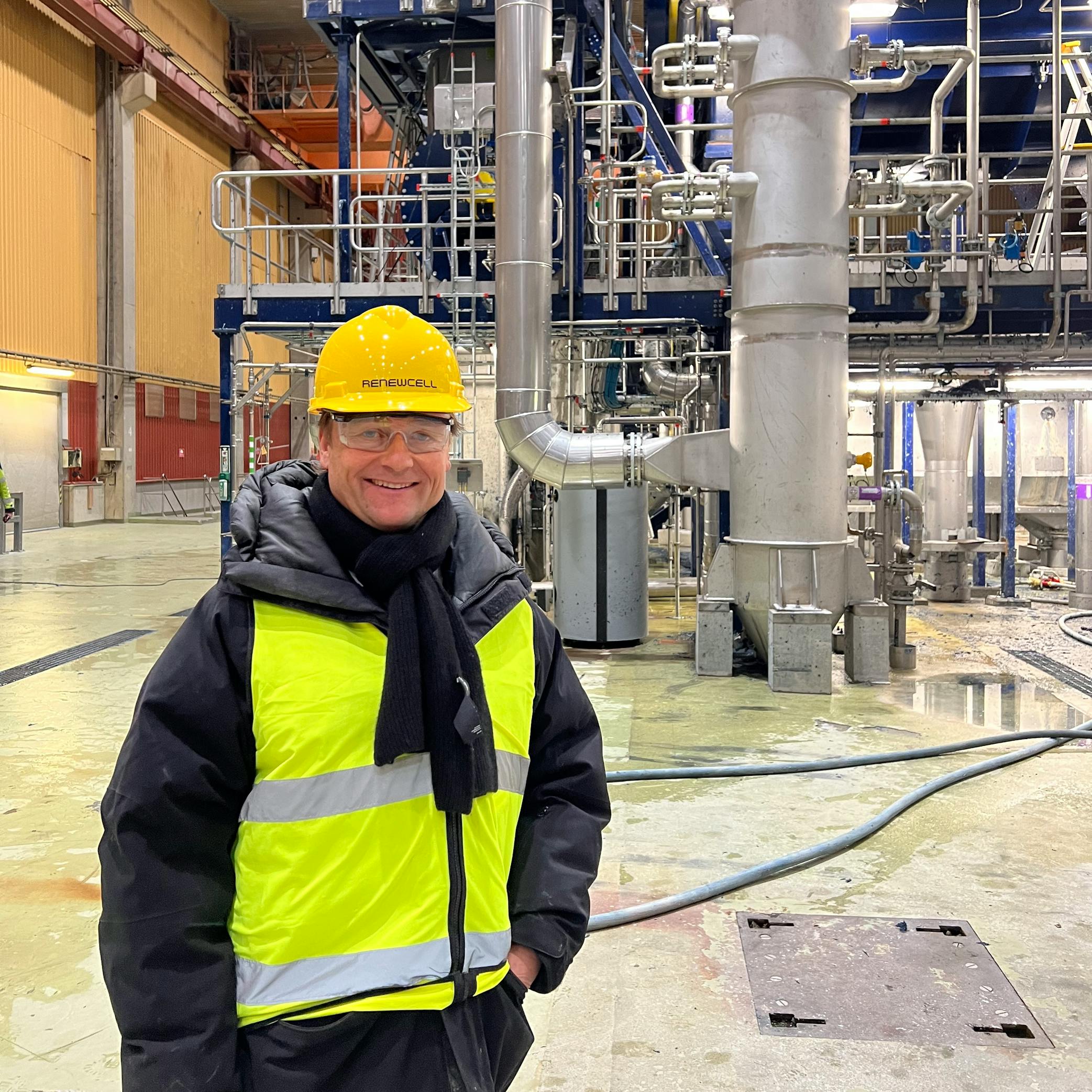

Investment Advisor

Per Aniansson

Per has more than 20 years of VC experience, with CEO positions at two medtech companies and a CFO position at another VC backed start-up. Per is currently Investment DIrector at Karolinska Development and on the board of several pharma development companies. He is also Chairman of Colorifix, a UK biotech company with a sustainable solution for dyeing in the textile industry, and Turnpike, a SaaS company. Prior to these current roles, he was Investment Director at Fouriertransform and a board member at OssDsign AB, Scibase AB, Renewcell AB, Powercell AB, SmartEye AB and AAC Clydespace AB. Earlier in his career, Per served as CEO of Icon Medialab Capital, was Nordic Managing Director for Siemens Mobile Acceleration, and was Investment Director at Innovationskapital, responsible for investments within Life Science at Industrivärden. He has also been a management consultant at Arthur D Little and Accenture. Per has a Masters of Science in Engineering Physics and a MBA.

Annual Reports

Latest Report

Cumulative Disbursements

+$40M

For the year ended December 31, 2024. Amount in U.S. dollars.

+30 Investments

Debt (35%), Equity (25%), Grant (40%)

Areas of Focus

Education ($5M), Climate Solutions ($16M), Conservation ($8M), Smart Agriculture ($11M), Sustainable Business Development ($2M)